Small passive income ideas. What you can do to earn more without more efforts?

I guess everybody is interested in cheap passive income ideas. You hardly can expect a person that he or she will be able to invest hundreds of thousands of dollars. So let's start with small passive income ideas.

Generating a passive income with small or no initial funds

It might be difficult to generate passive income without any initial capital because many possibilities may demand at least some time or financial input. It is crucial to approach the process with a realistic perspective and be prepared to put in effort and innovation, even if there are ways to produce passive income without major upfront expenses.

Consider low-cost choices or methods to make use of existing talents and resources to get started rather than concentrating only on the concept of creating passive income with no upfront capital. Even though it involves some initial commitment, passive income may be generated over time with perseverance and a willingness to try new things.

Make Money From Your Hobbies or Skills

The ability to monetize your abilities or interests is one of the simplest methods to generate passive income with no start-up costs. In a subject where you have expertise, such as writing, graphic design, or social media management, you can work as a freelancer or consultant. You may find clients who are prepared to pay for your knowledge by using websites like Upwork, Fiverr, and Freelancer.com.

Also worth reading Best side hustles for introverts

1. Sell Online your printable, downloadable Art and Design

Small passive income ideas. Sell printables and arts with Payhip

You may also sell your artwork or designs online if you're creative. You can publish your designs to websites like Redbubble, Society6, and Teespring and be paid for each sale. If you have a talent for photography, you may also sell your images on sites like Shutterstock, iStock, or Adobe Stock. Digital goods like printables, templates, and ebooks are also excellent sources of passive income.

Create your online store for digital items on Payhip. This platform has several important benefits:

- You can use it for free just being charged 5% for each sale.

- You will have all the necessary marketing tools to promote your online store.

- Payhip will provide you great website builder and technical support.

A digital product may be produced once and sold frequently without further labor. Online marketplaces like Payhip and Etsy are available for you to use. If you are a specialist in a certain field, you may write an e-book or online course and sell it on Amazon. You may easily publish and market your work on Amazon, and you can get passive revenue from sales.

2. Getting Your Assets Rented

Renting out your possessions is another way you may generate passive money. For instance, you may use Airbnb or Turo to rent out a spare apartment or your automobile. As an alternative, you may list your parking space for rent on services like JustPark or SpotHero if it's in a popular location. You may rent out your automobile to other users on the Turo network for a charge. Your vehicle may generate passive revenue for you without requiring any additional effort, and Turo offers insurance for each rental.

3. Crowdfunding for real estate investments

While an initial investment is necessary for real estate crowdfunding, it may be less than for conventional real estate investing. For instance, websites like Fundrise and RealtyMogul let you put as little as $500 or $1,000 into real estate initiatives, making it far more inexpensive than outright purchasing a physical asset.

For people who are interested in real estate investment but lack the funds to purchase a house on their own, this might be a suitable choice. Furthermore, platforms for real estate crowdfunding take care of property management, so you don't have to worry about dealing with renters, maintenance, or other concerns that come with owning physical property. For individuals who want to invest in real estate but do not want to deal with the difficulties of property management, this may be a decent alternative.

4. Make a mobile application

It's crucial to remember that developing a mobile app can be a lucrative method to earn passive income, but that this option is often only practical for people who have coding knowledge or can hire a developer. A sizeable sum of money may be needed up front to cover development expenses like employing a programmer or designer.

After the app is created, you may make money off of it by selling in-app items, subscriptions, or advertisements. Users may be able to access more features or material in the app through in-app purchases, such as a subscription to the premium edition. Access to exclusive material or services may be offered as a subscription service. You may generate advertising money by including advertisements in your app or by working with other businesses to market their goods and services to your customers.

5. Investing in dividend-paying ETFs

There are a few choices accessible to you if you want to invest in dividend-paying ETFs but have little money to start with. The majority of dividend-paying ETFs have no minimum investment restriction, so you may start with a little sum.

Additionally, to cut the costs connected with your investment, search for ETFs with lower expense ratios. A different choice is to make investments in fractional shares of ETFs, which let you purchase a part rather than the entire share. This allows you to invest with less money, which may be very advantageous if the ETF you're interested in has a high share price.

It's crucial to do your homework and pick an ETF that matches your financial objectives and risk tolerance when buying dividend-paying ETFs. Look for ETFs that invest in businesses that have a history of consistent dividend distributions and a solid track record of financial stability. By purchasing many dividend-paying ETFs from various industries or geographical areas, you may further diversify your portfolio.

6. Participate in peer-to-peer lending

You may invest in loans to people or companies through peer-to-peer lending services like LendingClub or Prosper. Even if you lack the initial capital to contribute, peer-to-peer lending may be a fantastic method to produce passive income over time. There is sometimes a minor minimum investment requirement on peer-to-peer lending systems. Start modest and progressively raise your investment when you start to see a return on your capital.

Reinvest interest income from your peer-to-peer loans as it comes in order to expand your portfolio. Over time, this may enable you to produce even more passive money. To reduce risk, it's crucial to diversify your assets among a number of lenders. This entails making investments in loans to a range of borrowers with various loan amounts and credit scores.

Do complete due diligence and research on the platform and borrowers before investing in any peer-to-peer loans. To assist you in making a wise investment choice, consider their track record, loan default rates, and any other pertinent data. You may start investing in peer-to-peer loans by following these steps and eventually produce passive income without having to make a sizable initial commitment.

7. Establish a niche website

Cheap passive income ideas: build website

If you have knowledge in a certain field or are enthusiastic about a certain subject, building a niche website is a terrific method to get passive income. It's critical to pick a niche with a big enough audience to provide considerable traffic and earnings.

After selecting a niche, you may build a website and provide material on the subject. This might be any form of material that is pertinent to your area, such as articles, videos, podcasts, or others. Then, you may monetise your website through a variety of strategies, including advertising, affiliate marketing, or the sale of niche-specific items.

One of the most popular methods to monetise a specialty website is through advertising. You can either sell ad space directly to advertisers or use ad networks like Google AdSense to run adverts on your website. The number of people that visit your website and the volume of traffic you produce will determine how much money you make.

It's crucial to remember that even while creating passive income would take some initial investment, the potential rewards could eventually amount to a lot. You may create a dependable passive income stream that can eventually replace your normal income by making wise investment decisions and waiting patiently for your returns.

There are still methods to get started if you lack the cash to take advantage of any of these possibilities. For instance, you may utilize free platforms like WordPress or Udemy to get started if you want to establish a blog or make an online course. There is no minimum investment needed to start investing in individual equities through a brokerage account if you wish to buy dividend-paying stocks.

You may develop your digital goods using free tools like Canva and sell them on free online services like Payhip if you wish to sell them. Additionally, you may start by advertising a spare room in your home or apartment if you wish to rent out a room on Airbnb and progressively expand your listings over time. Without significant initial money, you might start to get passive income by starting small and using free resources.

For the blog or the niche website, you definitely need hosting and domains find it on Host4Biz.

8. Market digital goods

This is one of the possible variations of the niche website. The assets or media that make up digital products are intangible to customers. They contain PDFs, templates, plug-ins, and other downloadable or streamable materials like Kindle novels.

Because they offer large profit margins, digital goods become excellent revenue streams. By using your web business, you may sell the item often after just making it once. Storage and inventory are not required.

9. Provide online education

Selling classes online is simpler than ever for teachers. You may easily make pre-recorded courses and start selling them, whether your interests are in marketing, drawing, or entrepreneurship. Passive revenue may be generated by selling online courses frequently without keeping any stock or inventory.

Some time must be set out in advance for online teaching. You'll need to develop downloadable materials, such templates, for students to take away from your course, as well as an outline, a recording, and other resources.

Whatever perspective you choose, offering online courses as a teacher is a terrific way to make money with little initial commitment other than your time.

For publishing your courses you can create a website with Payhip or use Udemy.

Why creating online course may be a source of passive income? The reason is that you can sell courses to thousands of people. That means the item with a price 20 USD can bring you thousands of dollars.

10. Become an influencer on social media

This idea is an example of how you can monetize skills and hobbies. Of course, it requires some work, but if you are doing everything right, profit will grow exponentially. Let's take a look at how it works.

You need to create a community of individuals who share your interests if you want to become a social media influencer — someone who can affect another person's purchasing decisions.

Do you enjoy comic books? You may open an Instagram account and begin regularly posting about the newest Marvel and DC television programs. The same holds true if you have a passion for sports, scuba diving, interior design, or even just general culture.

If your audience is active, you can utilize that activity to promote a number of passive revenue concepts. For instance, you may collaborate with both big and little companies to market their goods to your audience. Alternatively, you may earn money by selling your own merchandise.

11. Rent a vehicle

You may rent out other properties as well as your house to generate passive income. Using a service like Turo, you can also hire out your vehicle. If you currently utilize your vehicle to provide Uber services, you may sign up with websites like Carvertise or Wrapify to make extra money while you travel around the city.

Finding someone who needs a car for Uber or Lyft is another option to make money with your vehicle. Therefore, you can load up a Netflix program while your car is doing the driving for you rather than actively driving about in your spare time.

12. Make loans to your peers

Unproductive excess money lying around? A side business idea is peer-to-peer lending. Loaning money to borrowers or small companies is the basis of peer-to-peer lending.

To simplify the process, you may register on a website that links borrowers and lenders, such as LendingClub, Prosper (for individuals), or Worthy (for enterprises).

Loan requests and interest rates depending on the borrower's past are often available on these websites. Usually between 5% and 6% of these loans get a return. You'll have a bigger cash flow as you lend more money.

13. Launch a YouTube channel

Launching a YouTube channel is still possible. Every month, 2.6 billion individuals utilize YouTube throughout the entire world. That's a lot of potential customers to bring in for passive money. Now what? It takes a lot of labor upfront for initially little to no reward.

A successful YouTube channel has great earning potential, though, if you have a long-term perspective and don't mind front-loading your work. As you build up content, clicks, and views, as well as as you expand your audience. Affiliate sales, sponsorships, branded integrations, and ad revenue may all pile up passively. Even better, you can quickly branch out and launch a podcast to increase your income through sponsorships.

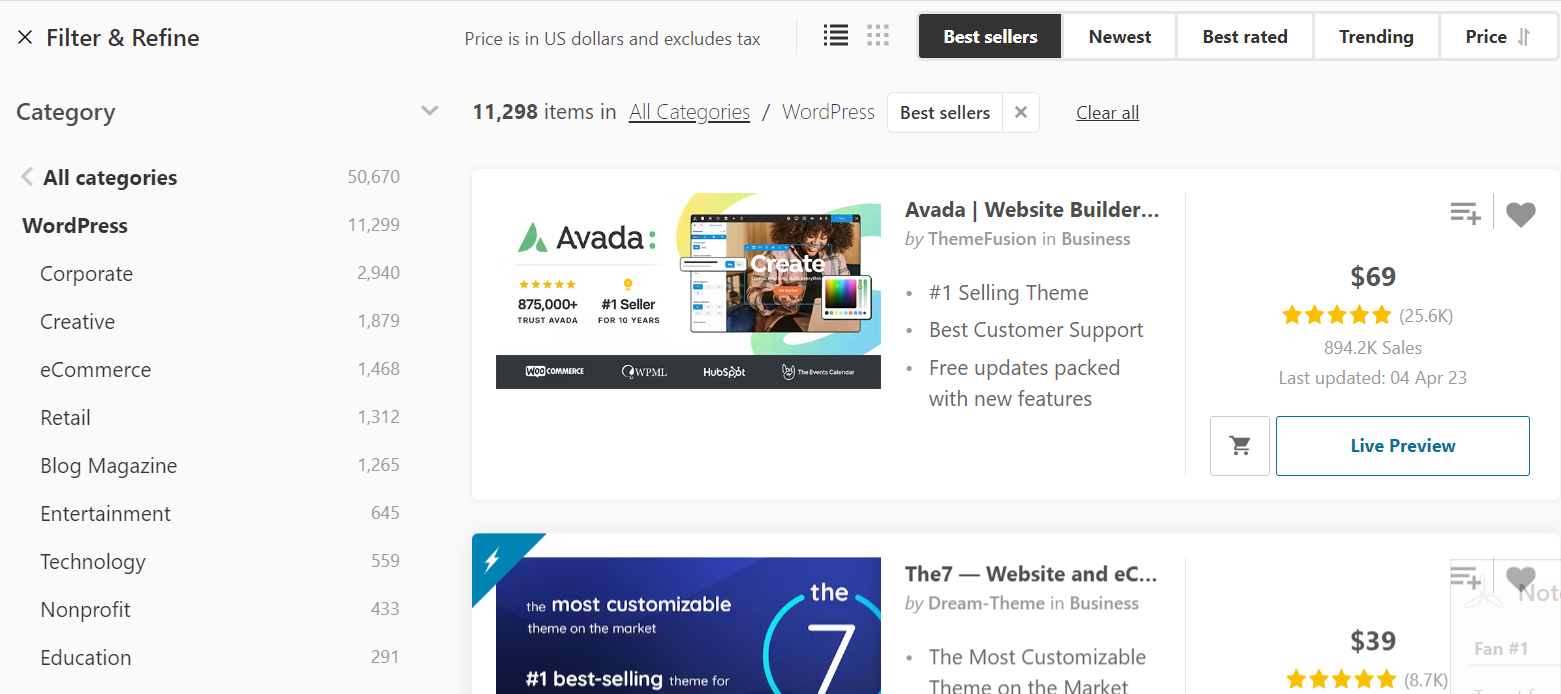

14. Offer designs online

Selling digital designs on design marketplaces like 99designs, ThemeForest, or Creative Market is a terrific way to start a passive revenue stream. These platforms provide a built-in market that is already hungry for design materials, regardless of whether you utilize a website builder to create website themes, logos, branding resources, templates, drawings, or even fonts.

Passive income ideas with no money or minimal investments: sell website designs

For instance, you would have to apply and wait for approval if you wanted to begin selling designs on Creative Market. From there, you obtain your own retail space where you may begin offering your exclusive creations for sale.

15. Invest in companies

Today, it is definitely viable to begin investing in previously unreachable company prospects. With a $100 minimum deposit and no investor fees, platforms like Mainvest make it simple to invest passively.

the profits? It varies, just like with other investments. Mainvest, however, intends to increase your earnings by 10% to 25%. Even better, you don't even need to investigate the companies. Mainvest handles the vetting procedure on your behalf. You only put up the initial money.

This is a fantastic, risk-free method to enter the world of company investment and learn as you go as a passive income concept.

From passive income to financial independence

Finding ways to earn a lot of money more quickly might provide you the freedom you need to take your personal finances to the next level because there are only so many hours in the day. Adding passive revenue streams with various underlying economics can provide you the flexibility to explore it, whether that level is taking a great trip or purchasing that fantastic pair of shoes.

Passive income ideas FAQ

How can I get $1,000 in passive income each month?

Diversification is essential for a passive income of $1,000 per month. You can make investments in rental properties, peer-to-peer lending services, or equities that generate dividends. These investments produce consistent returns without requiring your personal participation.

How can I earn $2,000 a month passively?

Create your own assets, such as a dropshipping company or a YouTube channel, to passively earn $2,000 a month so that you have more control over your income. To make money while engaging in this active employment, you can also purchase vending machines or set up a job board.

What kind of passive income is the simplest?

Investing in index funds or dividend equities is most likely the easiest way to generate passive income. You may start with a small initial investment and gain over time from compound interest with these alternatives, which need no administration.

How can I get passive income without any cash?

Create digital items like e-books or online courses and sell them through self-publishing sites like Amazon Kindle or Teachable to generate passive revenue using your talents or experience. These goods can produce cash once they are developed with little continuous work.