Cybersecurity SaaS EU Market Entry: Go-to-Market Strategy Case

Client Overview

Cyrima is a cybersecurity SaaS product operating at the intersection of risk management, compliance automation, and delivery workflows. The product addresses real regulatory pressure — GDPR, NIS2, DORA, ISO frameworks, but faced a classic challenge: the market clearly needed the solution, yet buyers struggled to immediately understand where Cyrima fits, who it is for, and why to choose it now.

This is a typical situation for cybersecurity and compliance products entering the EU: high competition, high requirements to the product, complex regulations, crowded tooling landscape, and long decision cycles.

The Challenge

Before entering and scaling in EU markets, Cyrima faced several GTM risks:

- Blurred positioning between GRC platform, compliance tool, and security workflow solution = no niche – no market and real customers that understand what pain the solution is solving

- Too broad ICP: regulated enterprises, IT providers, auditors, partners — all relevant, but not equally actionable

- Multiple regulations creating fragmented buyer personas and messaging

- Pricing tiers that risked over-delivering value in the free plan

- No clear prioritization of which market segment to attack first.

The key task was not promotion, but strategic focus.

Go Global’s Approach

We ran a Quick Wins GTM Audit & Market Research, designed to clarify direction fast and create a scalable entry point into the EU.

1. Regulatory-Driven Market Mapping

We started from regulation — not from features.

By analyzing how GDPR, NIS2, DORA, and ISO standards impact different industries, we identified where compliance pressure is:

- Mandatory

- Time-sensitive

- Budget-backed

This allowed us to separate theoretically relevant markets from commercially viable first-entry segments.

2. ICP Prioritization: Focus Before Scale

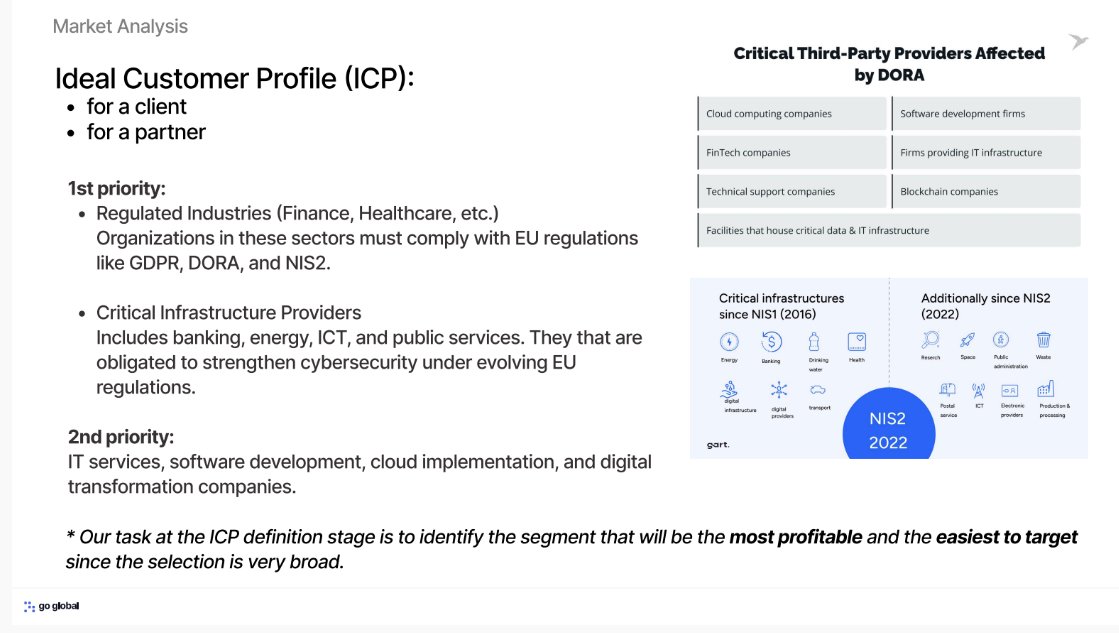

Instead of “selling to everyone affected by compliance,” we structured the ICP into clear priorities:

Primary ICP

- Regulated industries (finance, healthcare, energy)

- Critical infrastructure & ICT providers under NIS2 / DORA

Secondary ICP

IT services, cloud, and digital transformation companies acting as compliance enablers

We also separated:

- Client ICP (end buyers)

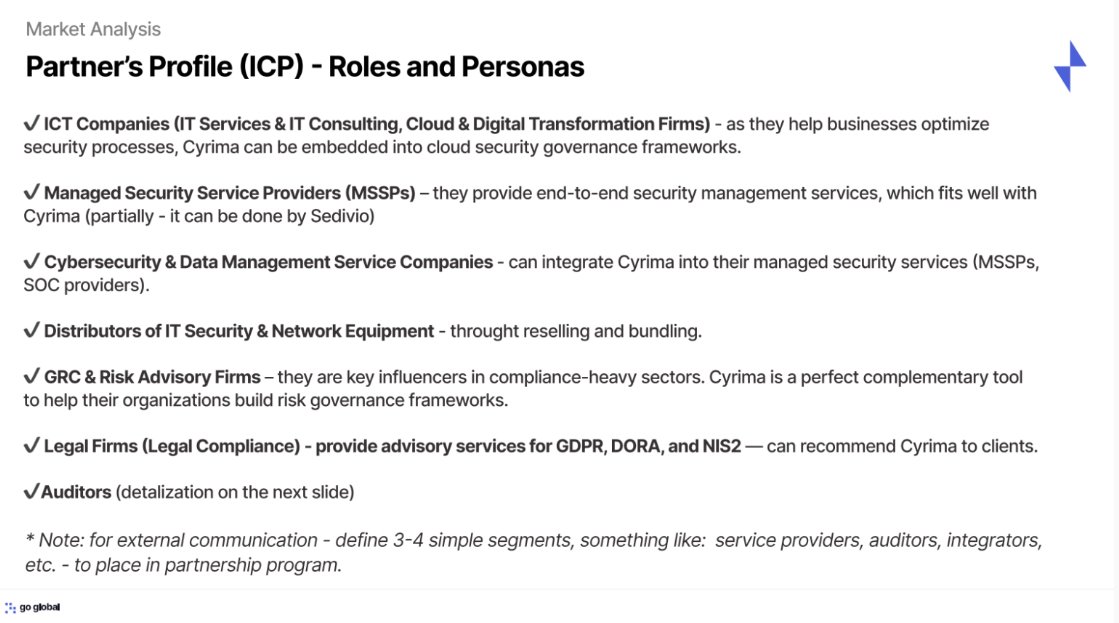

- Partner ICP (auditors, MSSPs, legal & risk advisory firms)

This unlocked two parallel GTM motions instead of one overloaded funnel.

3. Buyer Personas & Decision Logic

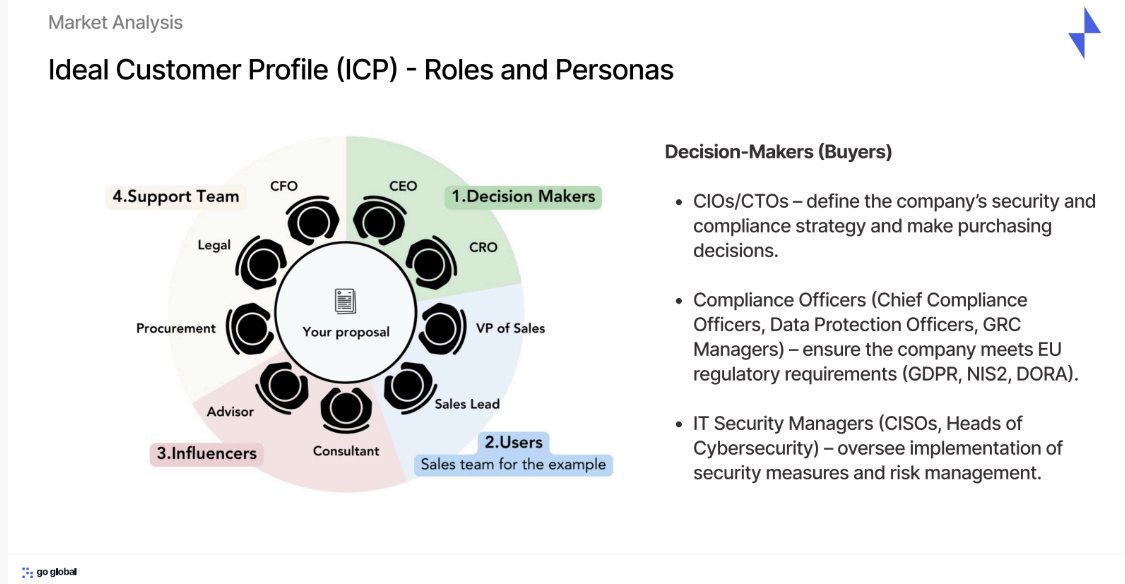

We mapped decision-makers, influencers, and end users:

- CIOs / CTOs

- CISOs & IT Security Managers

- Compliance & Risk Officers

- Delivery teams (DevOps, PMs, QA)

Messaging was rebuilt around decision logic, not product functionality:

- Audit readiness

- Risk ownership

- Reduced compliance friction

- Faster delivery without regulatory blockers.

4. Product Positioning Reframe

Cyrima was repositioned from a generic “GRC tool” to:

Cyrima was repositioned from a generic “GRC tool” to: a Jira-integrated tool (a compliance automation toolkit) that delivers ready-to-use solutions for security and regulatory compliance.

Instead of selling compliance as fear or obligation, the narrative shifted to:

- Operational clarity

- Predictable audits

- Fewer delays caused by security reviews

- Compliance that works with teams, not against them

This positioning became the foundation for sales pitches, website structure, and content.

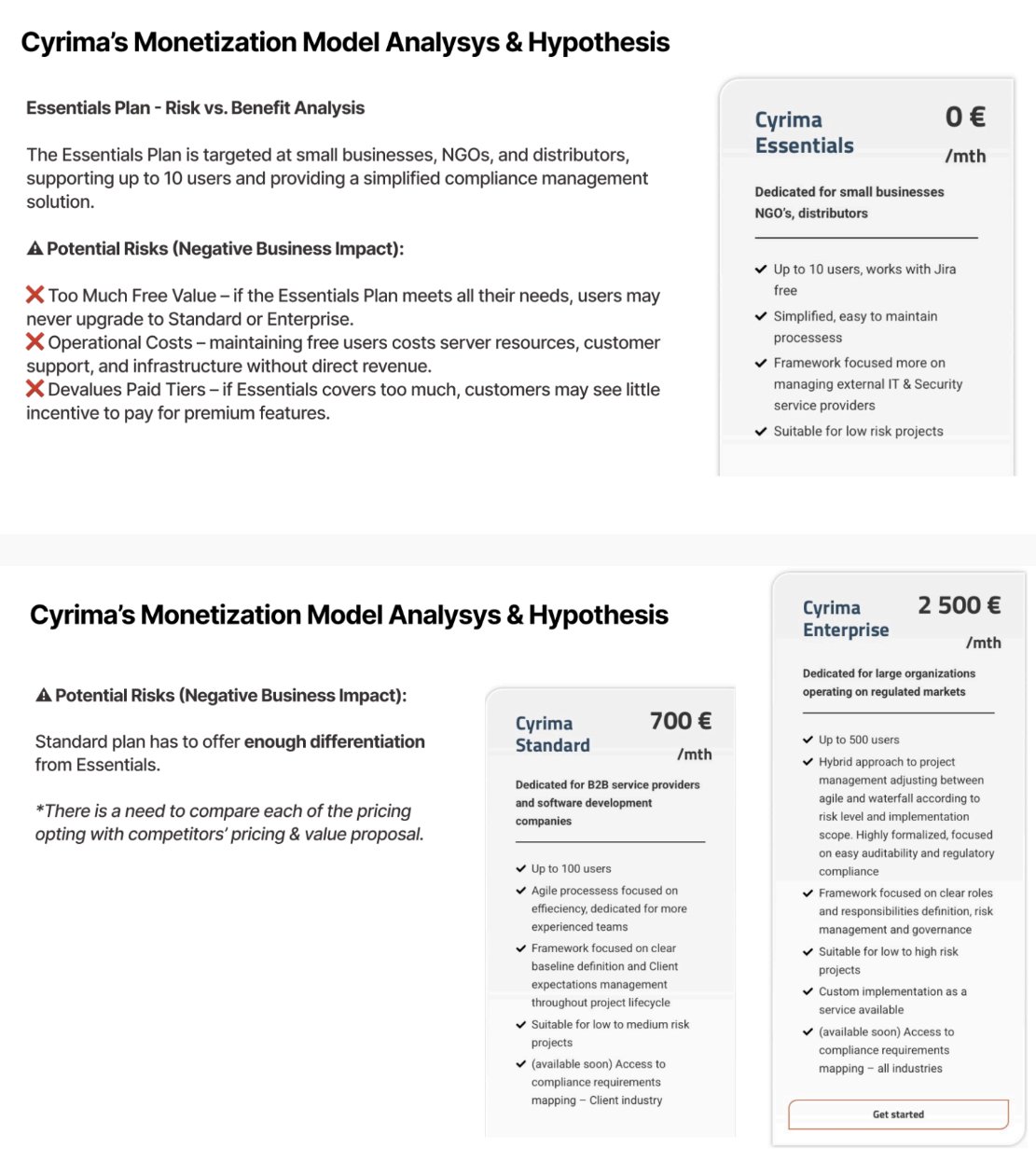

5. Pricing & Monetization Logic Review

We audited Cyrima’s pricing tiers and identified risks in the free plan:

- Too much value for non-paying users

- Weak incentives to upgrade

- Blurred differentiation between Standard and Enterprise

We proposed:

- Feature-based gating instead of only user limits

- Short premium trials to expose enterprise value

- Enterprise messaging focused on support, accountability, and risk management, not feature lists

6. Go-to-Market Blueprint

The final GTM strategy covered:

- Entry channels per ICP (SEO, ABM, partnerships)

- Regulation-driven content structure (NIS2, DORA, GDPR landing pages)

- Partner-led distribution via auditors and integrators

- Product-led growth logic (freemium → paid)

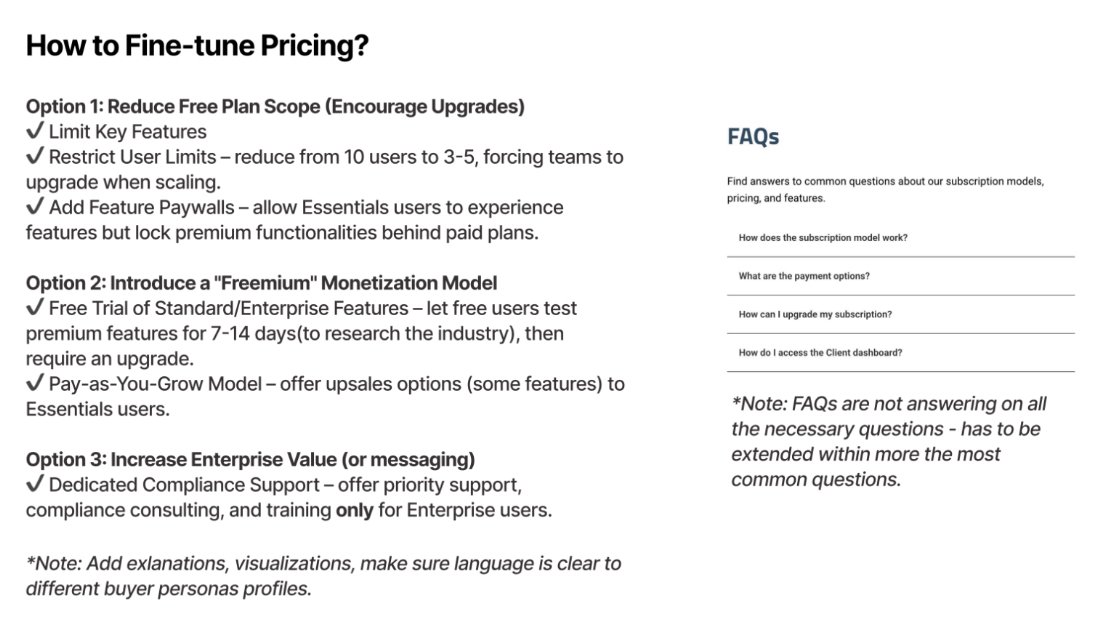

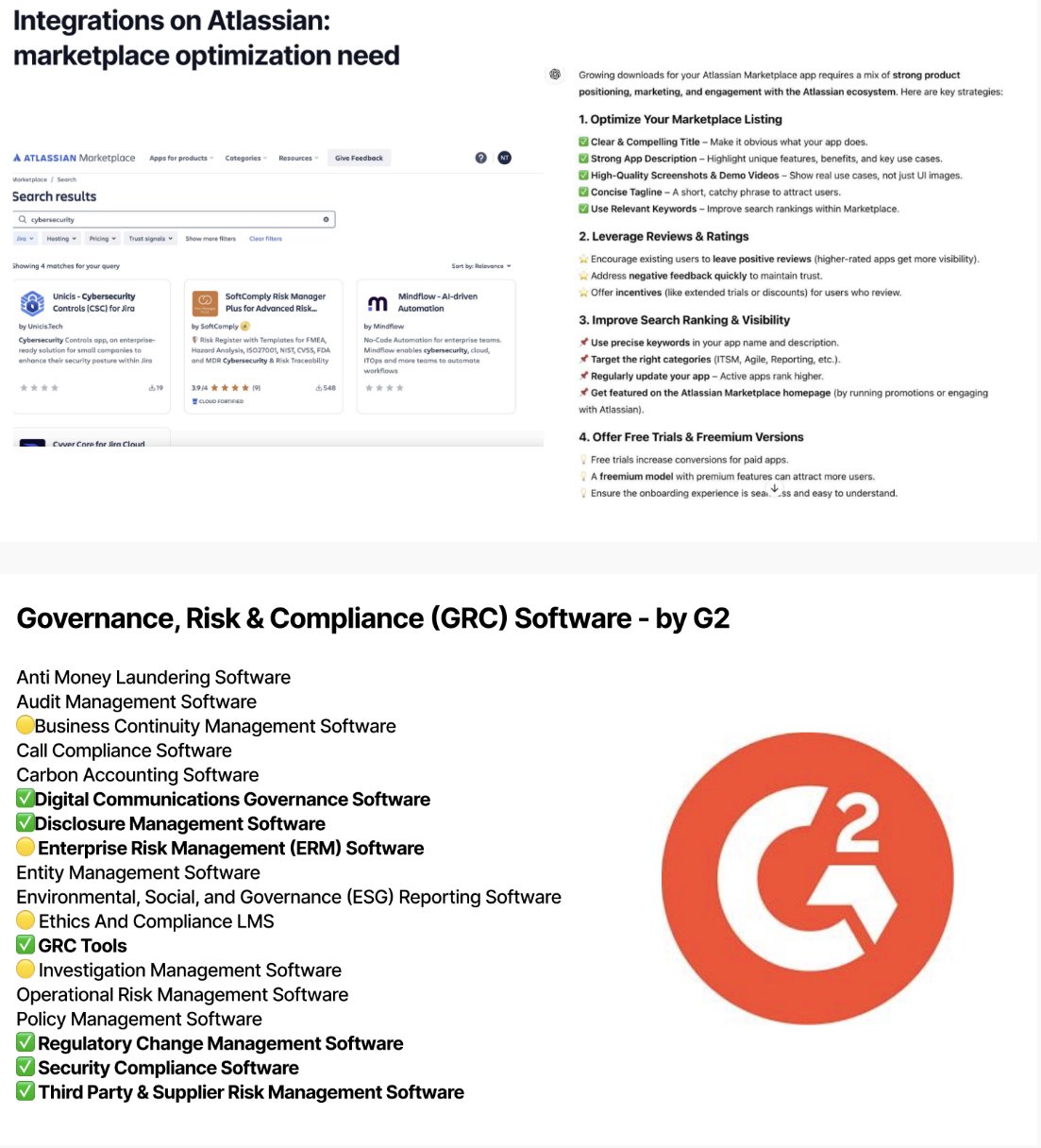

- Marketplace visibility (Atlassian Marketplace, G2, alternatives platforms)

All recommendations were delivered with clear execution logic, not abstract strategy.

6.1. Sales Strategy Approach

We advised Cyrima to build their sales strategy around regulatory urgency and decision ownership, not generic product demos.

Instead of one universal pitch, we structured sales motions by ICP and buyer role, separating enterprise, mid-market, and partner-led deals.

For regulated industries, the focus shifted to consultative selling: framing conversations around audit readiness, risk ownership, and compliance timelines (NIS2, DORA, GDPR), with tailored value propositions for CIOs, CISOs, and Compliance Officers.

In parallel, we recommended a partner-driven sales channel through auditors, MSSPs, and compliance advisors, enabling Cyrima to enter accounts with existing trust. This approach reduced friction in early conversations and positioned sales not as product sellers, but as guides through complex compliance decisions.

6.2. Strategic Marketing Quick Wins

As part of the engagement, we identified a set of strategic marketing quick wins that could deliver impact without rebuilding the entire system.

These included

- Clarifying website positioning around compliance outcomes rather than features;

- Restructuring key pages to map directly to regulatory triggers (NIS2, DORA, GDPR) and buyer roles;

- Fixing critical UX and messaging inconsistencies on the pricing and main pages that diluted trust;

- Introducing regulation-specific landing pages to support SEO and sales enablement;

- Defining a focused content angle around compliance automation and audit readiness;

- Preparing the foundation for presence on relevant marketplaces and review platforms.

These quick wins created immediate clarity, improved first impressions, and laid the groundwork for scalable demand generation.

Result

As a result, Cyrima received:

- A clear EU market entry focus

- A simplified and sharper positioning for sales and marketing

- A structured ICP hierarchy aligned with regulatory urgency

- A monetization logic ready for scaling

- A GTM roadmap aligned across product, sales, marketing, and partnerships.

Export Plan

This created a solid foundation for scalable growth in a highly regulated market, without burning resources on unfocused outreach.

Conclusion

This case clearly shows why go-to-market execution fails when companies jump straight into tactics, skipping a strategic layer and market analysis.

Real growth in regulated and competitive B2B markets happens only when all four levels of B2B marketing are aligned:

- Business Strategy — clear revenue goals, market focus, value proposition

- Marketing Strategy — positioning, ICP prioritization, messaging, roadmaps

- Marketing Tactics — content, outbound, partnerships, ABM, SEO

- Marketing Operations — execution, processes, delivery, iteration.

4 levels of B2B Marketing

At Go Global, we work across all four levels of B2B marketing, not just execution. We help tech companies connect strategy with reality, turning complex products, regulations, and markets into a focused, scalable GTM system (check out our Go to Market toolkit if you are a product business)

Want to build a scalable visibility engine for your company?

Go Global helps tech companies:

- Clarify positioning in complex or regulated markets

- Define the right ICP before scaling sales and marketing

- Build go-to-market strategies that actually convert

- Align product, sales, partnerships, and marketing into one system.